New Goodyear Factory to Produce UHP Tires Four Times Faster

The Goodyear Tire & Rubber Company officially opened its new manufacturing facility…

Continue Reading

May 17, 2022

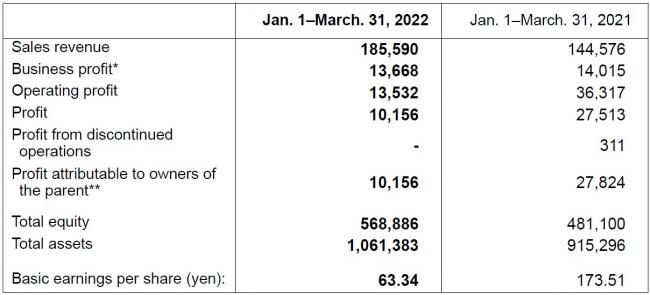

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first quarter (January to March) of fiscal 2022. Profit attributable to owners of parent declined 63.5% from the same period of the previous year, to 10.2 billion yen; on a 62.7% decline in operating profit, to 13.5 billion yen; a 2.5% decline in business profit, to 13.7 billion yen; and a 28.4% increase in sales revenue, to 185.6 billion yen.

* Yokohama Rubber divested its Hamatite sealants and adhesives business, formerly included in the MB (Multiple Business) segment, during the fiscal year ended December 31, 2021. It has reclassified its Hamatite business as discontinued operations in the figures presented below for the first quarter of that year.

*Business profit is equivalent to operating income under accounting principles generally accepted in Japan and consists of sales revenue less the sum of cost of sales and selling, general and administrative expenses

The figure for sales revenue was the highest ever at Yokohama Rubber in the January-to-March quarter. It reflected success in securing price increases for tires in North America and in other markets and the weakening of the yen against the dollar and the euro. Business profit declined despite the sales growth on account of the adverse effects of upturns in raw material costs and logistics expenses, the disruptions in global supply chains, and the challenges presented by the Covid-19 pandemic.

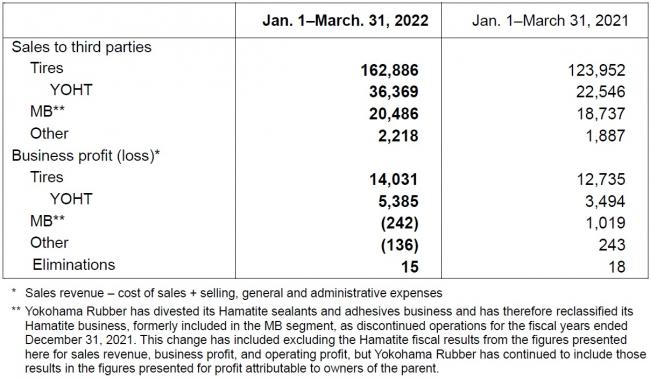

First-quarter sales revenue and business profit in Yokohama Rubber’s Tires segment increased over the same period of the previous year. Sales revenue in original equipment tires increased despite the adverse effect of global shortages of semiconductor devices on vehicle production volume.

In replacement tires, sales revenue rose overall. Yokohama Rubber promoted high-value-added tire products in Japan, introducing new products under the ADVAN series and other brands. Sales revenue benefited in Japan from heavy snowfalls, which stimulated demand for studless winter tires, and from a surge in purchases in advance of price increases. Sales revenue in replacement tires rose in North America and in India and other Asian markets outside Japan as Yokohama Rubber responded effectively to robust demand.

Yokohama Rubber posted solid growth in off-highway tires for agricultural machinery, industrial machinery, and other applications. The company formerly accounted for off-highway tire business as the ATG (Alliance Tire Group) segment, but it has transferred that business as Yokohama Off-Highway Tires to the Tires segment as of the present fiscal year. That move is in recognition of commonality between off-highway tires and Yokohama Rubber’s other tire business in regard to customers and to product characteristics.

In Yokohama Rubber’s MB (Multiple Business) segment, sales revenue increased over the same period of the previous year, but business profit declined on account of such factors as rising raw material costs and a tight labor market in the United States. Sales revenue in hose & couplings rose in Japan and overseas, led by strong sales of hoses for construction equipment. Yokohama Rubber also posted growth in sales revenue in industrial materials. That growth occurred despite weakening demand for marine products. It reflected successful measures to bolster sales of conveyor belts in Japan and a recovery in demand in the commercial aircraft sector for replacement fixtures and components. Yokohama Rubber formerly accounted for its business in aircraft fixtures and components as a separate product category, but it transferred that business to industrial materials as of March 30, 2022.

Management at Yokohama Rubber abides by the full-year fiscal projections for 2022 that it announced in February 2022. Those projections call for profit attributable to owners of parent to total 40.0 billion yen on operating profit of 58.5 billion yen, business profit of 60.0 billion yen, and sales revenue of 750.0 billion yen.

Under Yokohama Transformation 2023 (YX2023), the company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of our existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the company strives for “transformation” that will drive growth over the next generation.

The consumer tire business is aiming to maximize the sales ratio of its high-value-added tires during YX2023. Toward that end, the business has been making efforts to expand sales of its ADVAN and GEOLANDAR brands as well as its WINTER tires. Thus far in fiscal 2022, which has been positioned as a “YOKOHAMA New Summer,” the consumer tire business has introduced four new tires: the ADVAN Sport V107, a new global flagship tire; the ADVAN NEOVA AD09, a high-performance street tire; the BluEarth-RV RV03, a fuel-efficient tire for minivans that performs particularly well on rain-drenched roads; and the BluEarth-RV RV03CK, a fuel-efficient tire for compact minivans and light box wagons. The consumer tire business has also achieved successes in the OE market for premium cars and EVs, with YOKOHAMA tires being adopted by Mercedes-AMG and by Toyota Motor Corporation for its Lexus brand and most recently its all-new bZ4X, Toyota’s first-ever BEV (battery electric vehicle). Motorsports activities thus far in 2022 have produced a one-two finish in the GT300 class of the opening round of the 2022 SUPER GT series. In addition, a vehicle equipped with YOKOHAMA’s GEOLANDAR tires won its class championship at this year’s SCORE SAN FELIPE 250, a grueling off-road race held in Mexico.

The commercial tire business is exploring opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup. Part of that effort is the strengthening of Yokohama Rubber’s OHT business, which YX2023 has positioned as future growth driver. Toward that end, on March 25 the company agreed with Sweden’s Trelleborg AB to acquire all outstanding shares of Trelleborg Wheel Systems Holding AB. New commercial tires launched so far this year include the BluEarth 711L, an all-season tire for trucks, and the 505C, a wide-base tire for trailers. As part of the company’s response to the trends toward CASE and MaaS, it has teamed up with Alps Alpine Co., Ltd., to develop a technology that uses a sensor attached to the tires inner surface to monitor the wear condition of passenger car tires.

In the MB segment, Yokohama Rubber is continuing to concentrate its resources in the segment’s two strongest businesses—hose & couplings and industrial products—as it seeks to transform the segment into a generator of stable earnings. Accordingly, the hose & couplings division is expanding production capacity at its Ibaraki Plant, and the industrial products division plans to expand the Hiratsuka Factory’s conveyor belt production capacity by 1.3 times. As part of its effort to develop new services, the MB segment has begun field trials of a system that uses an RFID tag* to remotely monitor and predict damage to its in-use marine hoses and conveyor belts. As part of the segment’s structural reforms, the aerospace products division was integrated into its industrial products division at the end of March.

*RFID (Radio Frequency Identification) refers to a wireless automated recognition technology capable of reading and writing data using radio waves.

On the ESG front, Yokohama Rubber is implementing environment-related initiatives based on a three-pillar strategy focused on achieving carbon neutrality, a circular economy, and coexistence with nature. Recent accomplishments in the circular-economy domain include the acceptance of a joint project with Zeon Corporation to develop a resource recycling technology by the New Energy and Industrial Technology Development Organization (NEDO) as a Green Innovation Fund Project. In addition, the company’s development of tires using sustainable materials is being advanced by the start of trial runs of tires to be used in Japanese SUPER FORMULA Championship races and by the use of YOKOHAMA tires that include biomass-derived butadiene rubber by an EV competing in this June’s Pikes Peak International Hill Climb in the United States.

A recent society-related initiative is the formulation this April of the “Yokohama Rubber Group Human Rights Policy” based on the United Nations “Guiding Principles on Business and Human Rights.” Regarding information disclosures, Yokohama Rubber in April updated the disclosures on climate-related information on its CSR website and in its Japanese corporate governance report based on the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), which the company declared its support for this January. The above initiatives are the latest examples of Yokohama Rubber’s proactive ESG activities that have been highly evaluated for many years, as indicated by the company’s inclusion in the FTSE4Good Index Series, a leading global index for ESG investment, for 17 consecutive years.

Tire and Rubber Association of Canada

5409 Eglinton Ave W, Suite 208

Etobicoke, ON M9C 5K6

Tel: (437) 880-8420

Email: [email protected]