Nokian Tyre: Financial Statement Release 2021

Record high sales with improved profit “Nokian Tyres’ team did an excellent job in…

Continue Reading

Feb 17, 2022

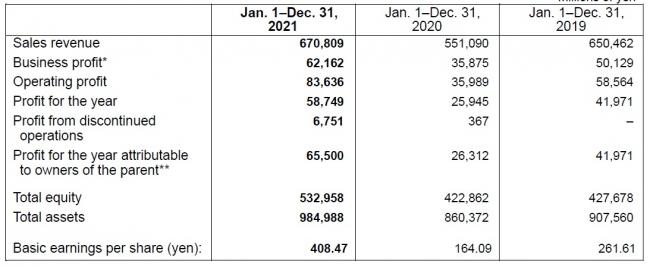

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for fiscal 2021 (January to December 2021). Sales revenue increased 21.7% over the previous year, to 670.8 billion yen; business profit increased 73.3%, to 62.2 billion yen; operating profit increased 132.4%, to 83.6 billion yen; and profit attributable to owners of parent increased 148.9%, to 65.5 billion yen. All of those figures were record-high for full-year performance at Yokohama.

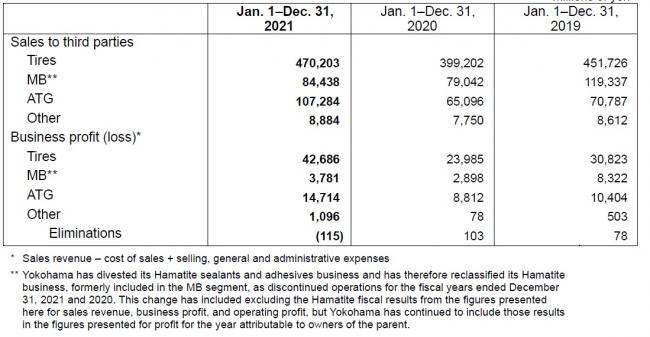

* Business profit is equivalent to operating income under accounting principles generally accepted in Japan and consists of sales revenue less the sum of cost of sales and selling, general and administrative expenses * Yokohama has divested its Hamatite sealants and adhesives business. The company has therefore reclassified its Hamatite business, formerly included in the MB (Multiple Business) segment, as discontinued operations for the fiscal years ended December 31, 2021 and 2020. This change has included excluding the Hamatite fiscal results from the figures presented here for sales revenue, business profit, and operating profit, but Yokohama continues to include those results in the figures presented for profit attributable to owners of parent.

The upturns in sales revenue and earnings reflected Yokohama’s success in implementing price increases for tires in North America and other overseas markets and the weakening of the yen against other principal currencies. Those factors more than compensated for the adverse effects of upturns in raw material costs and logistics expenses, of the disruptions in global supply chains, and of the challenges presented by the Covid-19 pandemic.

Both sales revenue and business profit increased over the previous year in Yokohama’s Tires segment. The company’s sales of original equipment tires increased as the adverse effects of the Covid-19 pandemic abated somewhat. That increase occurred despite the continuing adverse effect of the global shortages of semiconductor devices vehicle productions. Yokohama also posted sales growth in replacement tires. It promoted sales of high-value-added products worldwide, as with the Japanese launch of the iceGUARD 7 studless snow tire. The company achieved sales gains in North America, in Europe, and in Asian markets outside Japan, led by Indian business.

Sales revenue and business profit also increased over the previous year in Yokohama’s MB segment. Business in high-pressure hoses expanded, led by strong sales of hydraulic hoses in the resurgent construction equipment sector. Sales were basically flat in industrial materials, as delays in large projects undermined replacement business in marine products and offset Japanese sales growth in conveyor belts. In aircraft fixtures and components, sales declined on account of weak demand in the commercial sector.

Yokohama’s ATG (Alliance Tire Group) segment, too, generated growth in sales revenue and business profit, both of which reached their highest level ever. That segment comprises business in tires for agricultural machinery, industrial machinery, and other off-highway applications, and sales increased over the previous year in all of the ATG segment’s principal product categories.

Management projects that full-year sales revenue in 2022 will increase 11.8% over the previous year, to 750.0 billion yen, and thus reach another all-time high. The continuing upward movement in energy and raw material costs and in logistics expenses are taking a toll, however, on earnings, and management projects that business profit will decline 3.5% from the previous year, to 60.0 billion yen; that operating profit will decline 30.1%, to 58.5 billion yen; and that profit attributable to owners of parent will decline 38.9%, to 40.0 billion yen. Management will recommend paying a year-end dividend of 33 yen and will declare an interim dividend of 33 yen, which would result in an annual dividend 66 yen.

Yokohama has absorbed the ATG segment into its Tires segment as of 2022. That is on account of similarities between the two segments in regard to customers and product characteristics. The company will thus report results in reference to three segments: Tires, MB, and Other.

Under Yokohama Transformation 2023 (YX2023), the Company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of our existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the Company strives for “transformation” that will drive growth over the next generation.

The consumer tire business is aiming to expand the sales ratio of high value-added tires from 40% in 2019 to more than 50% by increasing sales of YOKOHAMA’s ADVAN, GEOLANDAR, and WINTER tires. Toward that end, it has been making efforts to expand OE use of ADVAN and GEOLANDAR brand tires, strengthen sales in the replacement market, and expand size lineups, including for WINTER tires. As a result of these efforts in fiscal 2021, YOKOHAMA tires were adopted as OE on several premium car makers’ new models, including Mercedes-AMG’s G63 BRABUS series, and Toyota Motor’s Land Cruiser with overseas specs and its Lexus NX. In addition, the consumer tire business introduced new winter tires for passenger cars, vans, trucks and buses as part of a “YOKOHAMA New Winter” launched primarily in Japan and Europe. These efforts and the steady expansion of tire size lineups increased the sales ratio of high value-added tires to 41%.

In fiscal 2022, the consumer tire business will continue to promote the use of its ADVAN and GEOLANDAR tires as OE on premium cars. This effort will include the launch of a “YOKOHAMA New Summer” that will seek to expand sales of summer tires, including the newly released ADVAN Sport V107, ADVAN NEOVA AD09 and two new BluEarth tires. These efforts are expected to increase the sales ratio of high value-added tires to 42% or higher.

The Company’s commercial tire business is exploring opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup. YX2023 has positioned the off-highway tire (OHT) business as a future growth driver. To strengthen this business, Yokohama Rubber’s OHT business has been integrated with those of group subsidiaries ATG and Aichi Tire to establish a global OHT business named Yokohama Off-Highway Tires (YOHT). In addition, to respond to robust global demand for OHT, the Company has decided to expand the capacity of a plant currently under construction in India to 2.2 times more than the initial plan. As for DX, the commercial tire business has been supporting transportation-related businesses with its Tire Management System (TMS), also has begun testing a new business model called TPRS, which remotely monitors the tire air pressure on passenger cars. Going forward, it plans to use the analysis of data collected by these systems to expand its services.

MB segment resources are now being concentrated in its two strongest businesses—hose & couplings and industrial products—in an effort to transform the segment into a generator of stable earnings. Initiatives to strengthen and expand the MB segment’s business in fiscal 2021 included an investment to triple production capacity at its hose & couplings plant in China, and the aggregation of the industrial products group’s production of marine hoses at its Hiratsuka plant in Japan and a plant in Indonesia. In addition, the Hamatite business was sold and transferred in November as part of the MB segment’s business restructuring. In fiscal 2022, the hose & couplings business will expand capacity at its Ibaraki Plant and reorganize its North American production of automotive hoses & couplings. The industrial products business aims to expand its share in Japan’s conveyor belt market, and MB segment will accelerate the structural reform of our aerospace products division by merging it into the industrial products division.

Yokohama Rubber regards ESG activities as an important strategy that will contribute to the strengthening of its business and lead to sustainable increases in its corporate value. The Company’s environment-related initiatives are based on a three-pillar strategy focused on achieving carbon neutrality, a circular economy, and coexistence with nature, which will support the achievement of the first two goals. A roadmap for achieving medium-to-long term goals in each of these pillars has been established. Over the medium term to 2030, the Company plans to reduce CO2 emissions directly generated by the Company’s activities by 38% from the 2013 level. The longer term goal is to achieve carbon neutrality by 2050. Efforts to realize a circular economy aim to increase the ratio of renewable and recyclable materials used by the Company to more than 30% of total materials used by 2030. This January, Yokohama Rubber declared its support for the recommendations put forth by the Task Force on Climate-Related Financial Disclosures (TFCD), and going forward the Company will proactively disclose information about its ESG activities, including the progress of its climate-related initiatives.

Tire and Rubber Association of Canada

5409 Eglinton Ave W, Suite 208

Etobicoke, ON M9C 5K6

Tel: (437) 880-8420

Email: [email protected]