Hankook Tire Receives Korean Tire Industry’s First SBTi Approval for Its GHG Emission Reduction Target

Global leading tire company Hankook Tire & Technology (Hankook Tire) has received…

Poursuivre la lecture

Août 14, 2023

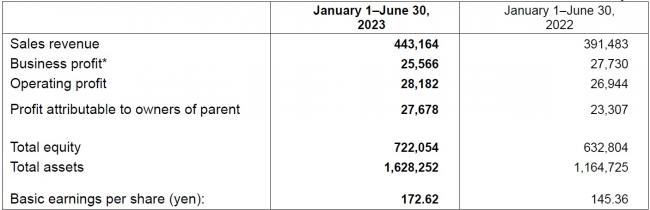

The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first half (January to June) of fiscal 2023. Profit attributable to owners of parent increased 18.8% over the same period of the previous year, to 27.7 billion yen, on a 4.6% increase in operating profit, to 28.2 billion yen; a 7.8% decline in business profit*, to 25.6 billion yen; and a 13.2% increase in sales revenue, to 443.2 billion yen. * Basically equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses.

Yokohama Rubber’s sales revenue in the period under review was the highest ever for the company in a six-month period. The sales growth reflected stepped-up marketing of high-value-added tires, improvements in the product mix in the company’s tire sales portfolio, and progress in securing price increases for tires. It also reflected sales gains in every principal product category in Yokohama Rubber’s MB (Multiple Business) segment and the weakening of the yen against other principal currencies.

The business profit decline reflected the adverse effect on profitability in Yokohama Rubber’s Tires segment from increases in raw material costs, in energy costs, and in selling, general and administrative expenses and a sales decline in off-highway tires for agricultural equipment and other applications. Contributing to the increase in profit attributable to owners of parent were gains on sales of idle assets and a gain on the divestiture of a tire wholesaling subsidiary in the United States.

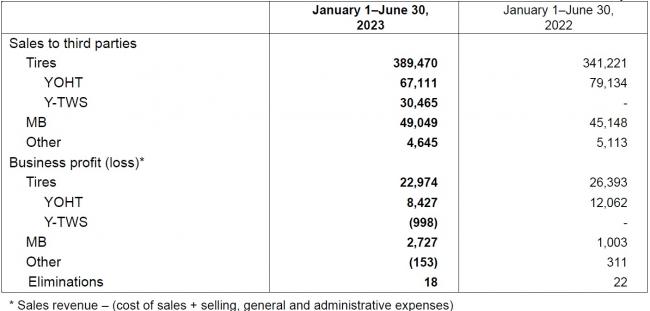

First-half sales revenue in Yokohama Rubber’s Tires segment increased over the same period of the previous year, but business profit declined. Sales revenue in original equipment automobile tires increased, supported by recoveries in new-vehicle sales in Japan and in North America. Those recoveries more than offset the adverse effect of weak sales for Japanese automakers in China.

Sales revenue increased in replacement tires. Business in Japan benefited from early-year snowfalls and resultant vigor in sales of winter tires. In overseas markets, Yokohama Rubber achieved sales growth in high-value-added products, such as ADVAN-brand high-performance tires and GEOLANDAR tires for SUVs and pickup trucks, in Europe and in China.

Yokohama Rubber posted a large increase in sales revenue in off-highway tires for agricultural machinery, industrial machinery, and other applications. Sales declined in the legacy business of YOHT (Yokohama Off-Highway Tires), which the company handled as the ATG (Alliance Tire Group) segment prior to 2022. More than offsetting that decline was the sales contribution from the acquisition, completed in May 2023, of the Swedish company Trelleborg Wheel Systems Holding AB (TWS). That company has operated since the acquisition as Y-TWS.

Sales revenue and business profit increased over the same period of the previous year in Yokohama Rubber’s MB segment. Sales revenue in hose & couplings increased, supported by a recovery in vehicle production in North America. In industrial materials, sales increased as Yokohama Rubber achieved business growth in conveyor belts in Japan and overseas and as the company posted a strong sales performance in marine products. Sales revenue increased in aircraft fixtures and components, reflecting robust demand in the commercial aircraft sector.

Yokohama Rubber abides by the full-year fiscal projections for 2023 that it announced in May 2023. Those projections call for sales revenue of 1.0 trillion yen, business profit of 84.5 billion yen, operating profit of 87.0 billion yen, and profit attributable to owners of parent of 57.0 billion yen. Management has declared an interim dividend of 34 yen per share, an increase of 1 yen over the interim dividend originally scheduled, and plans to recommend a year-end dividend of 34 yen per share. That would bring the full-year dividend to 68 yen per share, an aggregate increase of 2 yen over the previous year.

Under Yokohama Transformation 2023 (YX2023), the company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of its existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the company strives for « transformation » that will drive growth over the next generation.

The consumer tire business is aiming to expand the sales ratio of high value-added tires from 40% in 2019 to more than 50% by increasing sales of its ADVAN, GEOLANDAR, and WINTER tires. Toward that end, the business has been making efforts to expand use of ADVAN and GEOLANDAR brand tires as original equipment (OE), strengthen sales in the replacement market, expand size lineups including for WINTER tires, and strengthen sales of tires suited to local market needs. In the OE market, Yokohama Rubber’s strong efforts to increase adoption of its tires for electrified vehicles led to their adoption as OE on the new Lexus RZ, Lexus’ first battery electric vehicle (BEV), and on the new bZ3 electric vehicle (EV) sedan being sold by China’s FAW Toyota Motor Co., Ltd. In addition to OE on electrified vehicles, a number of new SUVs and luxury minivans are now coming factory-equipped with YOKOHAMA’s ADVAN and GEOLANDAR tires. In the replacement tire market, Yokohama Rubber is endeavoring to expand sales under two 2023 marketing themes. The “Mud Match” campaign seeks to expand sales of the GEOLANDAR brand while the ADVAN CHALLENGE seeks to maximize sales of ADVAN tires during the brand’s 45th year. Having launched its new GEOLANDAR A/T XD in North America and other markets this past March, the consumer tire business is now preparing for the autumn launch of the new GEOLANDAR CV 4S in North America, Europe and elsewhere. As part of the ADVAN CHALLENGE, the ADVAN Sport EV, an ultra-high performance summer tire for EVs will be introduced in overseas markets this autumn. Yokohama Rubber expects these new additions to further expand its sales of high value-added ADVAN and GEOLANDAR brands. The company also continues to strengthen brand recognition through its participation in motorsports, and ADVAN-equipped cars achieved some notable results in the first half of 2023. In addition to a season-first GT500 class victory in Round 3 of this year’s SUPER GT Series, ADVAN successes have included overall championships in Rounds 2 and 4 of this year’s Nürburgring Endurance Series in Germany and a second straight overall championship at Pikes Peak International Hill Climb in the United States, this year on ADVAN tires with a 33% sustainable materials ratio. Meanwhile, a GEOLANDAR-equipped machine won the King of the Hammers’ 4900 Can-Am UTV race, an off-road race in the United States that is considered one of the toughest off-road races in the world.

The commercial tire business continues to explore opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup. After being acquired by Yokohama Rubber in May, TWS has made a new start as Y-TWS, and synergies generated by combining the strengths of the two companies in all areas will propel Yokohama Rubber’s OHT business into a new growth stage. In the truck and bus (TBR) business, the Mississippi Plant in the United States improved its supply capacity and returned to the black in the recently completed first half. Yokohama Rubber is also strengthening its response to the shift to EVs that is accelerating around the world. In Japan, the commercial tire business expanded practical testing of its tire solution services to EV buses and also began the first deliveries of Yokohama Rubber tires for use on EV trucks.

In the MB segment, Yokohama Rubber is continuing to concentrate its resources in the segment’s two strongest businesses—hose & couplings and industrial products—as it seeks to transform the segment into a generator of stable earnings. The industrial products business, which has a long track record of strong sales of pneumatic fenders, expanded its product lineup by entering the larger market for solid fenders. The industrial products business plans to strengthen its earnings base by gradually expanding its solid fender lineup. Meanwhile, Yokohama Rubber is proceeding with a review of all its MB businesses as it continues to implement measures to improve the segment’s earnings.

Yokohama Rubber regards ESG activities as an important strategy that will contribute to the strengthening of its business and lead to sustainable increases in its corporate value. Environment-related initiatives in the first half targeting achievement of carbon neutrality included the startup of a new solar panel power generation facility at the Shinshiro-Minami Plant and the installation of a renewable energy power source at the Mishima Plant. Recent efforts focused on realizing a circular economy included the development of a rubber material that can be easily recycled without deterioration and maintains rubber’s excellent durability. Meanwhile, Yokohama Rubber’s Ibaraki Plant’s activities promoting coexistence with nature (i.e. nature-positive activities) were recognized by the plant’s receipt of the ABINC award from the Association for Business Innovation in harmony with Nature and Community. Social-related initiatives in the first half included an internal workshop on human rights due diligence and continued support for the employee-backed YOKOHAMA Magokoro Fund, disaster-stricken areas, and other organizations that contribute to society. Lastly, corporate governance measures included the continued unwinding of cross-shareholdings and other initiatives aimed at improving capital efficiency and achieving sustainable increases in corporate value.

L'Association canadienne du pneu et du caoutchouc

5409 Eglinton Ave W, Suite 208

Etobicoke, ON M9C 5K6

Tel: (437) 880-8420

Email: [email protected]